One of the most common questions we receive from clients is whether PSLF is worth it. Yes, they get the qualifying payments during their residency, but what about when they’re an attending? Are those high payments worth it? What if they take a pay cut to work at a non-profit to qualify, and then the PSLF rug is swept out from underneath them? Those are all valid concerns, and we attempt to answer them here.

There is no doubt in anyone’s mind that student loans cause stress. However, because of the tenets of behavioral finance, we know that not everyone views money the same exact way. For some of us, those loans are a necessary annoyance. For others, they dominate lives.

For those who feel a crushing sense of doom looking at their loan balance and just want it gone, this is for you.

When we work with these types of clients, the two options they gravitate towards most are refinancing and/or putting every cent they have towards the loans. Mathematically, they are not wrong. By securing a lower interest rate and paying down loans, you will pay less over the long-run, and you will not have your loans for as long. But what else is going on? What are the other options? What are you giving up by going down those paths?

During your residency, while you are making payments, you are generally only just putting a small dent into the accumulating interest. You will likely come out of residency with a hefty accumulated interest amount, and then spend your first couple of attending years paying down that interest before dipping into principal.

When you refinance, accumulated interest does not really exist. The bank is not as generous as the government, and they want to be paid the same amount, every month. One of the consequences of this is that you will see your principal balance go down much faster than if your loans were federal.

However, when you refinance, you lose your flexibility. If you lose your job, the federal government will take pity and allow you to go into forbearance while you get back on your feet. The bank is not so sympathetic. The Biden administration has voiced a desire to make changes to the student loan industry. If there is any sort of forgiveness, private borrowers will not be impacted. The government wants to reward you for a career in public service through the PSLF program, but the bank could not care less what your profession is, as long as they get paid.

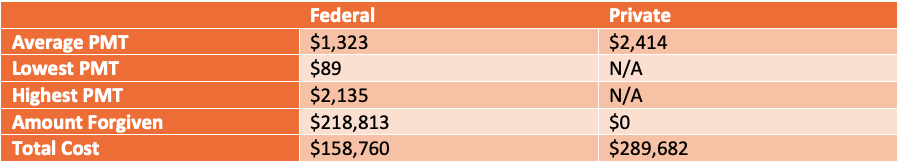

Let’s run a case study. Dr. John Doe is a PGY1 and wants help with his loans. He has $250,000 in federal student loans. He wants to know if he should refinance. He is in primary care, and feels pretty confident that he could work at a non-profit in his future attending position. He makes $60,000 as a PGY1, and estimates his salary to increase by 3% annually during his residency. He expects to make $200,000 his first year as an attending, and then expects it to increase to $250,000. He is unmarried with no children, and is on REPAYE, which he will remain unless he refinances. If he refinances, he is confident he can get a 3% interest rate, and only wants to be in repayment for 10 years.

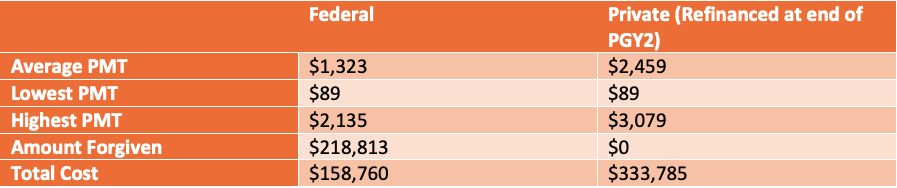

Clearly, Dr. Doe should keep his loans federal and continue on with PSLF. Now, let’s say that he is two years into his residency, and now is feeling a little bit more nervous about his loans. A lot of his friends are going into private practice for their attending positions, and they’re making $300,000 a year. They’re telling him to forget this PSLF thing, refinance, and pay down the loan as quickly as possible. With his higher salary, he thinks he could put an extra $500 per month towards his loans.

By refinancing his loans during his residency and then making extra payments, Dr. Doe ends up spending a considerable amount of money on his loans; more than double what PSLF would cost him. But what about his increased salary?

Not including taxes, Dr. Doe would have made an additional (gross) $370,000 over the course of the seven years in his attending position in private practice compared to if he had stayed at his nonprofit.

Even with the increase in spending on his loans, he is still “in the black” on this deal.

But let’s look at the other factors at play here. When he refinanced, his payments increased by about $1,000 per month on average, and he was spending the extra $500 per month in extra payments. That is a drastic increase in cash flow compared to if he had kept his loans federal. What else is going on in his life? Was he able to save to buy a house during that time? Was he able to save an adequate amount for retirement? Did the pinched cash flow cause him more stress than his loans?

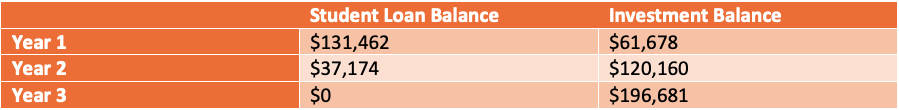

Let’s say that Dr. Doe refinanced as a PGY2, following the above example. But now he is in his second year of being an attending, and he has a lot of extra cash flow. Uncertain of exactly what to do with the excess, he puts every penny he has into his loans. This works out to $5,000 per month being put towards his loans. But what if instead of putting that money towards his loans, he put it towards the market? Which is the better decision in the long run? Let’s assume he get’s an average return of 6% in the market annually.

Which scenario is better? His student loan is only at 3%, so logically, it makes more sense to invest at 6%. Which would cause you less stress? Would having the nest egg there in the background be more comforting, even with the loans? Would the knowledge that you could pay them off whenever you wanted give you some security? Or does the sheer fact of having debt attached to your name scare you so much that you would rather pay it off and forgo the potential profits in the market? There is no solidly correct answer to any of these questions, because they all rely on our own personal view of finance.

Don’t be quick to take financial advice from those around you. Just like in medicine, what works for one patient may not work for someone else. We all have our own experiences that shaped us, and that is okay. It is all about finding your solution. Just make sure you’re exploring all your options.